With Condos resale prices and rent prices reaching all time highs, I thought it would be interesting to see the cost of buying vs renting in a few Toronto Neighbourhoods.

I’ve specifically chosen these neighbourhoods for their high concentration of condos.

I'm limiting this study to 1 and 1+1 Bedroom units that offer both a locker and a parking space, with sales and leases since June 1st of 2018. This is a typical setup most first time home buyers or renters look for. The study is limited in each neighbourhood by the immediate surrounding areas. I chose both 1 and 1+1 bedrooms since there isn't a huge difference in rental prices between them.

I’m also using median rather than average prices. For those that don’t recall the term, the Median is the middle number in a list. I’ve generally found this is a better gauge for pricing of what people expect for the ‘common’ or ‘general’ condo. When using averages, having a few luxury units in the data set can heavily skew the numbers.

I’ve specifically chosen these neighbourhoods for their high concentration of condos.

- Liberty Village/King West Village

- Downtown City place/Entertainment District

- Yonge and Eglinton

- Yonge and Sheppard

- Humber Bay Shores (Park Lawn and Lakeshore)

- Scarborough Town Centre

- City Centre Square (Mississauga)

I'm limiting this study to 1 and 1+1 Bedroom units that offer both a locker and a parking space, with sales and leases since June 1st of 2018. This is a typical setup most first time home buyers or renters look for. The study is limited in each neighbourhood by the immediate surrounding areas. I chose both 1 and 1+1 bedrooms since there isn't a huge difference in rental prices between them.

I’m also using median rather than average prices. For those that don’t recall the term, the Median is the middle number in a list. I’ve generally found this is a better gauge for pricing of what people expect for the ‘common’ or ‘general’ condo. When using averages, having a few luxury units in the data set can heavily skew the numbers.

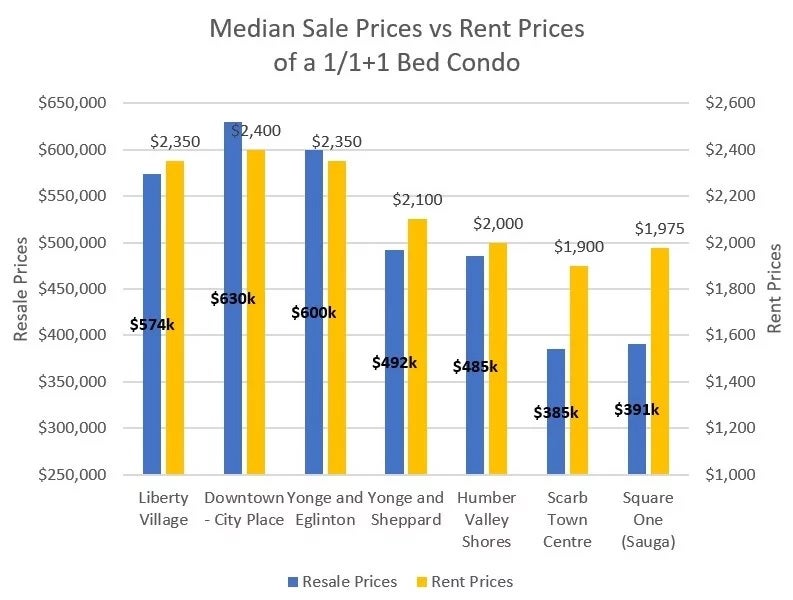

Interestingly enough – though there is a pretty wide gap in resale prices for downtown vs other neighbourhoods, that gap isn’t nearly as wide in rental prices. Leasing a one bedroom condo around square one in Mississauga, is comparable to what it costs around Park Lawn and Lakeshore, which is quite accessible to downtown. However buying around square one is considerably cheaper than buying around Park Lawn and Lakeshore.

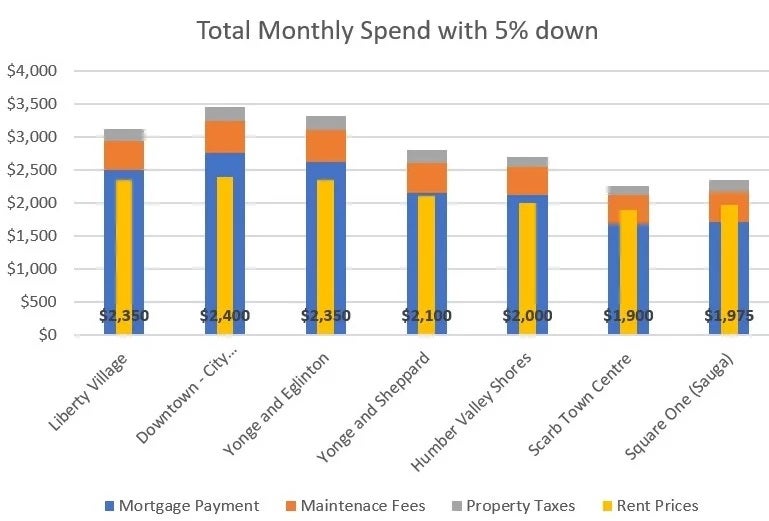

This is a strong indication of how stressed renters must feel in the rental market. Renters aren’t getting very much of a break by moving further away from the core, so it’s a stressed market anywhere they go. From looking at the graph, it’s also clear there’s a difference in value by neighbourhood from renting vs buying. The large differences in resale prices don’t translate over to similarly large differences in rental prices. Which neighbourhoods is it cheaper to buy vs rent? To assess that, we have to look at the costs of ownership in a condo: mainly mortgage payments, maintenance fees and property taxes. We can exclude utilities, and home insurance, as tenants would have to pay those fees either way. For this piece I’ll assume a 30 year mortgage with an interest rate of 3.69%. This is a fairly accessible rate that I pulled off of ratehub.ca, and is currently on offer by a couple of the major banks. Now assuming a down payment of 5% which is the minimum amount allowed for properties under $500k, it’s pretty clear that the total monthly spend is more for owners than the cost of rent in any neighbourhood:

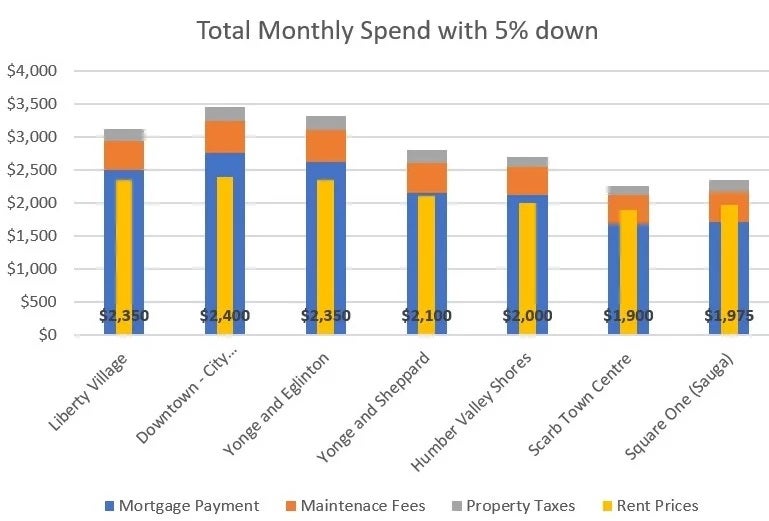

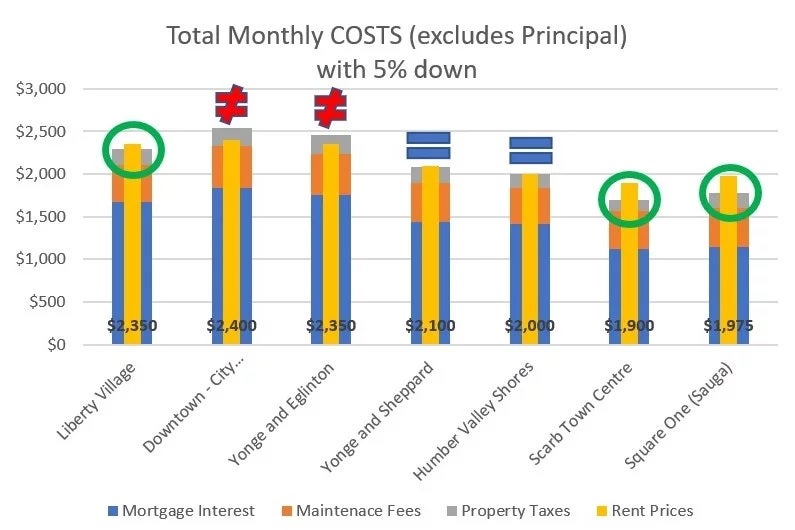

However if we subtract the principal that’s paid in each mortgage payment, in most neighbourhoods owning is equivalent or cheaper than renting. The principal is the amount of a mortgage payment that goes directly to paying off the debt of your total mortgage. When you sell your property, that amount will generally be returned to you from the proceeds of the sale. Mortgage interest, maintenance fees, property taxes and rent are all costs and money that won't be recouped.

This is a strong indication of how stressed renters must feel in the rental market. Renters aren’t getting very much of a break by moving further away from the core, so it’s a stressed market anywhere they go. From looking at the graph, it’s also clear there’s a difference in value by neighbourhood from renting vs buying. The large differences in resale prices don’t translate over to similarly large differences in rental prices. Which neighbourhoods is it cheaper to buy vs rent? To assess that, we have to look at the costs of ownership in a condo: mainly mortgage payments, maintenance fees and property taxes. We can exclude utilities, and home insurance, as tenants would have to pay those fees either way. For this piece I’ll assume a 30 year mortgage with an interest rate of 3.69%. This is a fairly accessible rate that I pulled off of ratehub.ca, and is currently on offer by a couple of the major banks. Now assuming a down payment of 5% which is the minimum amount allowed for properties under $500k, it’s pretty clear that the total monthly spend is more for owners than the cost of rent in any neighbourhood:

However if we subtract the principal that’s paid in each mortgage payment, in most neighbourhoods owning is equivalent or cheaper than renting. The principal is the amount of a mortgage payment that goes directly to paying off the debt of your total mortgage. When you sell your property, that amount will generally be returned to you from the proceeds of the sale. Mortgage interest, maintenance fees, property taxes and rent are all costs and money that won't be recouped.

The cost benefits to owning only increase with a higher down payment. Here are the numbers at 10%:

And with a 20% down payment:

With Condos resale prices and rent prices reaching all time highs, I thought it would be interesting to see the cost of buying vs renting in a few Toronto Neighbourhoods. I’ve specifically chosen these neighbourhoods for their high concentration of condos.

With Condos resale prices and rent prices reaching all time highs, I thought it would be interesting to see the cost of buying vs renting in a few Toronto Neighbourhoods. I’ve specifically chosen these neighbourhoods for their high concentration of condos.

And with a 20% down payment:

Buying vs Renting a Condo in 7 Toronto Neighbourhoods.

November 2, 2018

- Liberty Village/King West Village

- Downtown City place/Entertainment District

- Yonge and Eglinton

- Yonge and Sheppard

- Humber Bay Shores (Park Lawn and Lakeshore)

- Scarborough Town Centre

- City Centre Square (Mississauga)

I’m also using median rather than average prices. For those that don’t recall the term, the Median is the middle number in a list. I’ve generally found this is a better gauge for pricing of what people expect for the ‘common’ or ‘general’ condo. When using averages, having a few luxury units in the data set can heavily skew the numbers.  Interestingly enough – though there is a pretty wide gap in resale prices for downtown vs other neighbourhoods, that gap isn’t nearly as wide in rental prices. Leasing a one bedroom condo around square one in Mississauga, is comparable to what it costs around Park Lawn and Lakeshore, which is quite accessible to downtown. However buying around square one is considerably cheaper than buying around Park Lawn and Lakeshore.

Interestingly enough – though there is a pretty wide gap in resale prices for downtown vs other neighbourhoods, that gap isn’t nearly as wide in rental prices. Leasing a one bedroom condo around square one in Mississauga, is comparable to what it costs around Park Lawn and Lakeshore, which is quite accessible to downtown. However buying around square one is considerably cheaper than buying around Park Lawn and Lakeshore.

This is a strong indication of how stressed renters must feel in the rental market. Renters aren’t getting very much of a break by moving further away from the core, so it’s a stressed market anywhere they go.

From looking at the graph, it’s also clear there’s a difference in value by neighbourhood from renting vs buying. The large differences in resale prices don’t translate over to similarly large differences in rental prices. Which neighbourhoods is it cheaper to buy vs rent?

To assess that, we have to look at the costs of ownership in a condo: mainly mortgage payments, maintenance fees and property taxes. We can exclude utilities, and home insurance, as tenants would have to pay those fees either way.

For this piece I’ll assume a 30 year mortgage with an interest rate of 3.69%. This is a fairly accessible rate that I pulled off of ratehub.ca, and is currently on offer by a couple of the major banks.

Now assuming a down payment of 5% which is the minimum amount allowed for properties under $500k, it’s pretty clear that the total monthly spend is more for owners than the cost of rent in any neighbourhood:  However if we subtract the principal that’s paid in each mortgage payment, in most neighbourhoods owning is equivalent or cheaper than renting. The principal is the amount of a mortgage payment that goes directly to paying off the debt of your total mortgage. When you sell your property, that amount will generally be returned to you from the proceeds of the sale. Mortgage interest, maintenance fees, property taxes and rent are all costs and money that won't be recouped.

However if we subtract the principal that’s paid in each mortgage payment, in most neighbourhoods owning is equivalent or cheaper than renting. The principal is the amount of a mortgage payment that goes directly to paying off the debt of your total mortgage. When you sell your property, that amount will generally be returned to you from the proceeds of the sale. Mortgage interest, maintenance fees, property taxes and rent are all costs and money that won't be recouped.  The cost benefits to owning only increase with a higher down payment. Here are the numbers at 10%:

The cost benefits to owning only increase with a higher down payment. Here are the numbers at 10%: And with a 20% down payment:

And with a 20% down payment: With a 20% down payment, buying is cheaper than renting in all neighbourhoods.

With a 20% down payment, buying is cheaper than renting in all neighbourhoods.

The take-away to all this is if you’re looking to move into a 1 bedroom condo today, and don't have more than 10% saved for a down payment – It’s still cheaper to rent than to buy in Downtown Toronto, but the price premium peels away as you move outside of downtown. In most other neighbourhoods, if you can afford spending more than the cost of rent each month for your mortgage payment, even with only 5% down it’s cheaper to buy than to rent. The mortgage payment will result in a higher monthly spend (vs renting), but a good chunk of your mortgage will go to paying down your debt principal, which becomes yours when you sell the unit.

For anyone curious on the exact dollars they would save by buying vs renting in a specific neighbourhood, feel free to email me at Jonathan@Realosophy.com

All data sourced through TREB